I received an email from one of my readers with the following comment:

I had a thought today when hearing one of the Republicans talking about how the tax cuts for the top brackets need to stay the same was because keeping the tax cut would allow them to create jobs.

But the tax cut is from 2002 or so. So they have had these tax cuts for a while and still have them today. So where are the jobs that extending the tax cuts would create? Shouldn’t they be here now?

Bush/Cheney/Rove tax cuts and other policies had over eight years to show results, and all they did was put the economy into the worst recession since the Great Depression. And the Democratic president before Bush left the economy in pretty good shape. Isn’t it time to give Obama the benefit of the doubt and let him work on the economy?

13 Comments

While I don’t think one could reasonably infer a 1:1 cause:effect ratio re: tax rates and job creation or GDP, it surely is a good debate question.

People seem to forget that the tax rates are levied on net income. My husband and I had one year in the nineties when our joint gross income was over $300K. (Those were the days.) After deductions our tax rate still didn’t reach 39.5%.

Ridiculous.

People have no understanding about taxes. On another blog a woman was complaining that when her husband got his bonus “the government took 53%. 53%!!!!!!!!!!!!!.” She has no understanding that the government did not take 53%. The tax tables took 53%. Anyone in business knows that the pay check you get your bonus is now multiplied by the frequency of your pay (weekly, every other week, or monthly) That shows an entirely fake total for the year and taxes: federal, state, local and social security are taken out as though that was your yearly income. (reason to claim ten dependents that one week) Now it sounds as though this man would max on social security contributions pretty soon (not medicare) plus when they do their tax return for 2010 with the deductions that BEAUZEAUX mentions, the rest comes back in a refund. (poor man’s savings account)

Yes, Ed, you are correct. That’s why checks with a lot of overtime are “taxed” more than regular checks. The payroll system only looks at that pay period’s wages and then extrapolates that for a whole year. So if one’s bonus is $2,000 and one’s payroll system is set to a weekly payroll, the system assumes that $2k represents 1/52 of a year’s pay, or $104,00 and withholds accordingly, even if the employee actually earns $40k per year.

I know someone who is an ultra right wing (but ironically gov’t paid) public high school economics teacher. He speaks, as do many conservatives, in sayings, platitudes, talking points and very non-specific generalities. When confronted with statistics and facts, instead of countering them with opposing facts, he either changes the subject or repeats the talking points without addressing the debate.

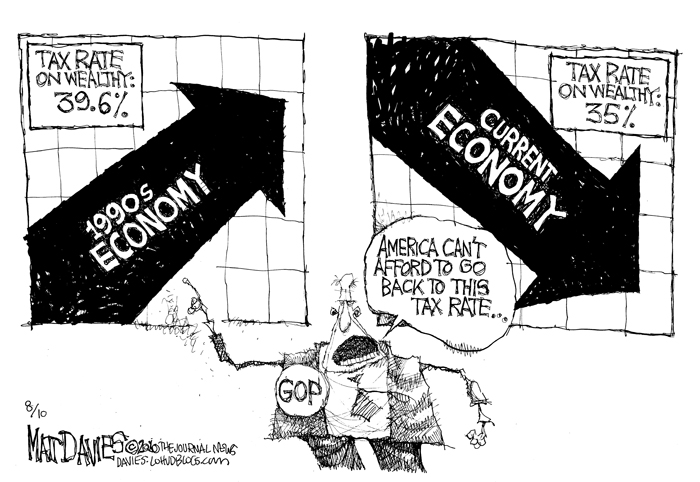

I’ve posed the question this cartoon poses, asking where the jobs are that should have theoretically been created by the ’01-’03 tax cuts. For good measure, I included a brief analysis of GDP over that same period. Funny, it’s a continual down arrow until – GASP! – Obama’s term began.

Excellent points by all. I think Beauzeaux hit upon something with the tax rates. Isn’t it time we fixed the tax code? I file my own taxes and have regular income, my wifes business income and my business income. It literaly takes a week (working in the evening) to finish the taxes. Now I admit I save adding up receipts etc. until that time, but still. Then I have to download and read all the various parts of the tax code to look for changes on things like office expense, depreciation, capital gains, etc.

I know many small business who end up showing a loss every year and hence no income to be taxed (except self employment tax which covers SS and Med)and 1/2 of that is deductible on the 1040.

We need a simpler tax code that is fair and equitable, much less complicated and actually collects tax. The non-profits get away with alot. In many of cases you don’t have to prove to anyone you are a non-profit to benefit from it.

I had my own business for 17 years. Every stamp was entered on quicken as I put the mail in the mail box. Every item was entered instantly. New Years day I hit “enter” on each catagory and pop, have my business return done in five minutes.

My sister over nighted hers to me. Trying to struggle through TurboTax with Business and K-1s. I begged her to let me do it. Took me one hour and fifteen minutes. She had things added. I would have charged her $125. She paid $500 the year before.

I can no longer charge for returns, but I need to do some (family and friends)to exercise my mind.

Office in home has gotten lenient again. Square footage of work space. Square footage of house. All your utilities and property taxes have been entered on Quicken or Money. You enter your house interest and Proterty taxes over on the “office in home” work sheet. TurboTax will then prorate the extra onto Schedule A for you.

I use Proseries, same company. I will learn TurboTax to help my clients learn to do it themselves as they bring their lap tops here and park them on my desk.

So when the time comes, if you have questions, ask. I, hopefully, will have time to help this year.

For twenty eight years doing taxes, I’ve regarded it as a big game. Get the most back with a ligitimate return.

I’m happy to hear that office in home has lightened up a bit. I had been using TurboTax for years and it was great. Easy to use even with our slightly complicated situation. But they were taken over by HRBlock and the whole program just went to guano. I might be trying out TaxCut next year, but if you have suggestions for a reasonably price program I’d love to hear it. I prefer to do my own taxes.

Shhh, don’t tell TurboTax, but I’d pay double for their online service. Lifesaver.

Thanks Ebdoug, I’ve used taxcut in the past as well and like all software when you get used to a particular product it’s hard to switch.

I’ll have to take your advice and try keeping up on the monthly expenses because thats what takes the most time. I appreciate the offer and I’m sure I’ll have questions concerning depreciate assets in the schedule E section of the return. (I hate to depreciate too much, rather pay now then later)

I got thinking about what you said about your rentals. try always to use straight line depreciation. Only problem with that is that your net is taxed at your current rate where if you do use an accelerated form of depreciation, when you sell you are taxed at Capital gain rates which are lower.

With your child going to college and thoughts of selling a rental, you really have to play the game to keep your income lower and get the $4000 tax credit for education. One way to do this is an Installment loan which is really like a private mortgage. Risky because if the buyer defaults, you have to reclaim the rental. Not sure you can use one with a rental property. You get to report your gain and interest spread out over the length of the loan.

I just checked. H&R block took over Tax Cuts. Intuit does TurboTax and Proseries. I have no idea which is best as I’ve never used either, just Proseries for my business. (I goggled “H&R block buys TurboTax” and got the answer.)

I have been using the straight line method. However when I make capital improvements (vs. repair and maint) ie. new AC/HEAT, replace kitchen, waterproof basements, etc. I don’t like to “add” them to the basis now so I don’t have to depreciate them (IRS wants them depreciated individually). My big question is (which I cn’t seem to find an IRS answer) will this come back to get me later when I sell and add them to the original basis thus reducing the capital gain?

Thanks for thinking about this, I appreciate it.