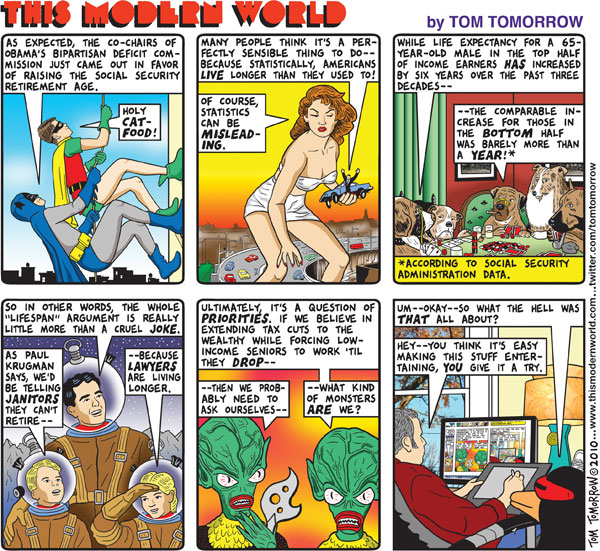

The largest increases in “average life expectancy” are actually due to a lowering of childhood death. Old people really aren’t living that much longer than they did when Social Security was originally established. And those who do live longer are primarily in the top half of income earners. Interestingly, the tax that funds Social Security is capped, which means that the lower income earners, who aren’t living as long, are effectively paying for the longer retirement years of the upper income earners. Only in America.

-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

10 Comments

The numbers are even worse for African Americans. Indeed, the cruel joke is that African Americans, as a group, put more into Social Security than they use because a larger proportion die before the age of 65.

I just finished a report looking at this issue here in MA. In 2007, 45% of African Americans who died were under 65 years old. Twice as many African Americans die between the ages of 40-55 years as White Americans.

This proposal would not only have serious impacts on lower income groups. It would have a very distinct racial impact as well.

Slavery was never abolished, they just changed the name to “employment” and made it legal for people to quit.

When Obama’s gov does something stupid=”only in america”

When Republicans say/do something stupid=and yet we vote them back in

Social Security is supposed to be like insurance — there if you need it. It is only reasonable that if we cap how much rich people can pay into it, then we should cap benefits to people who don’t actually need it. That would save a ton of money.

And most that don’t need it probably wouldn’t cry “foul”. I remember my mother collecting on my father’s social security. “Do you mind paying tax on it?” “Not one bit,” she replied. “I didn’t earn a penny of it.”

STARLUNA: Most of the proposals to balance the budget so far (to pay for Bush’s mess) are take from the poor and give to the rich. I don’t see “Take from the rich and give to the poor” mentioned. Of course, if the budget is balanced, the states are going to have to pick up the deficit. Taxes are going to soar on the state level.

EBDoug – that is already happening. The Feds have already cut some very important programs, like funding for police and fire departments and education. The new restrictions on Medicaid eligibility, particularly those targeting immigrants, have also impacted state and local budgets. Here in MA, the gap in Medicaid reimbursements for resident aliens is being made up by state funding, although with our current state deficit, that may go away too. In addition, community policing programs have been cut because of lack of funding. Property tax rates have increased in several communities here just to keep libraries open.

The good thing here is that people do seem to see the relationship between taxes and services. There was a ballot proposition in November that would have cut the state income tax almost in half. It was overwhelmingly defeated. On the other hand, a proposition to remove the tax on alcohol that funded alcohol and drug rehabilitation programs did pass. The supporters of this proposition actually said that they believe the tax on alcohol is “wrong” and that they hope that the state “finds the money somewhere” to continue to run the rehab programs.

And the Republican Party has already announced that they will block tax cuts for the middle class, unless they get their tax cuts for the rich. They won’t even compromise by having the tax cuts for the rich be temporary. http://tpmdc.talkingpointsmemo.com/2010/11/gops-top-tax-guy-republicans-will-block-permanent-middle-class-tax-cut.php

And to pass the new HCR the Dems are willing to cut 1/2 trill from medicare, several hundred Billion from education, food for the poor and housing for the poor. They did add a cadillac penalty for the rich, but nothing else aimed upward. So who are the only ones supporting the rich or against the poor? I think it’s the pot calling the kettle black if you ask me.

IK on the wealthy tax cuts, I think its too early (2 days into)in the lame duck to determine the outcome. Right now is just political posturing and chest pounding. They’ll compromise after a public display of impassioned rhetoric.

I think if you earn over 100k in retirement income you shouldn’t get any SS. How about all those local gov and police, and fire pension guys who double dip and get enormous gov pensions. They probably get SS as well.

One thing not mentioned here is that no one is required to apply for social security. The truely altruistic rich would not. Why should they?

Starluna: Since I had a tax client in Mass, I was able to watch the evolution of the health program. He married, didn’t put his wife on, was fined, etc. I could only think how stupid he was to not immediately want his wife to have health insurance. I applauded the requirement that all need to kick in. He has a comfortable salary so there was no reason. State fined him, he got health insurance for her. Wonderful example for the rest of the US. Although the Red States are cutting everything, hoping those in need will move to New York and Mass.