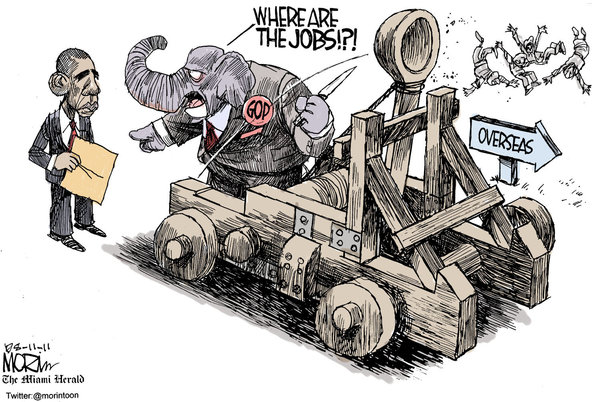

Have the Republicans actually done anything at all to create jobs? Well, other than their very tired and utterly refuted refrain that cutting taxes will fix our economy and increase jobs?

After all, if cutting taxes leads to job creation, then the end of Dubya’s presidency should have seen employment increasing instead of cratering. And between 1945 and 1964 — when taxes on income over $200,000 was over 90% — should have been a great depression (in case you can’t remember, it wasn’t).

Can anyone name one other thing the Republicans are proposing to put people back to work? Will they end subsidies for sending jobs to other countries? All I hear them promise is to repeal health care reform, end abortion, and “protect marriage”. How is that going to create jobs?

In fact, reducing the deficit, which appears to be the highest priority now that we don’t have a Republican president, seems certain to result in higher unemployment.

12 Comments

Kind of off topic, but are you saying that if a person made $200,000 then, they would only get to keep $20,000?

No, the tax on income above $200.000 was 90% implying that for every $ they earn after the first $200.000 they get to keep $0.10.

Tax on income below $200.000 was likely lower (with likely various brackets of tax rates and likely a first bracket with a tax rate of 0%)

ChinaGreenSleeves: First amount of income you earn, you pay no Federal Tax because of standard deduction and personal exemption, next you pay 10% on more income, then 28% on more income. Let’s say you earned $10 over the 15% level. You would pay 28% in taxes on the $10, not the rest.

In Eisenhower’s time $25,000 was a high income. Over that you paid 90% on the extra.

I don’t have a link to the interview, but Diane Rheim was interviewing one of the republican lobbyist/chattering class types. The interviewer kept asking about what the republicans were going to be doing about jobs, and the interviewee kept saying how the last year was one of the best years for revenues in years.

He was equating company revenues with job creation, and just could not hear that the interviewer wasn’t buying it. I don’t buy it either. Just because companies make money, that doesn’t mean they then created jobs.

Or, as the comic points out, even if they create jobs, they are not necessarily in the US. Especially when there are tax incentives for hiring elsewhere.

For a number of reasons (i.e., pressure from shareholders favoring short term over long term strategies) corporations aren’t able to hire now (causing short term expense) even though in the long run it would increase revenue because of increasing demand.

The Republican meme that money spent on taxes is fungible with money spent on employees is completely false. I’ve been a CEO of a company, and you always hire based on demand for your product, and never based on cash. In fact, if demand is rising and you don’t have the money to hire enough employees to meet that demand, then you borrow money. And right now, interest rates remain low, so this is cheap money. So now more than ever, stimulating demand stimulates the economy. It really is as simple as that.

CGE, we have progressive income tax, so (as people have already pointed out) you only paid that 90% on income *over* $200,000, which indeed was a huge income back then ($200,000 in 1945 dollars is equivalent to $2,462,685 today).

Actually, the top marginal tax rate hit 94% for a while back then. And yet somehow the economy grew. Dramatically. Imagine that!

The fact that many people don’t understand that the top marginal tax rate doesn’t apply to all income is often used by politicians to make lower income people think it is to their advantage to lower tax rates on the rich, when it doesn’t affect their taxes at all. Also, when many politicians say they want to “simplify” the tax rates, that is code for the flat tax where all income is taxed at the same rate, which would destroy our progressive tax system and likely dramatically raise taxes on the poor and middle class, and lower them on the rich.

One last thing — Thought Dancer, maybe those lobbyists can’t understand that corporate profits don’t equate with US jobs because corporate profits do equate with creating their jobs as lobbyists. Remember, it’s only an entitlement when someone else receives it! ®

Cutting taxes stimulates demand just as spending does, especially if aimed at low income people – something Obama could have pushed through if he wanted to. He didn’t.

Sometimes Presidents get unfairly blamed for a bad economy. But in this case, it’s totally fair. Obama screwed up.

Max-low income people pay practically no Federal Taxes, just sales tax and property tax in their rent. Most of the time working poor get more back then they put in with earned income credit. If they have children they get the child tax credit. Both refundable credits.

A friend of mine posted this on Facebook yesterday with the comment, “Can’t we go back to Republicans like this?”

http://www.reuters.com/video/2011/07/01/former-senator-alan-simpson-wall-st-does?videoId=216660927&videoChannel=4300

(Warning: strong language from an elderly man. Keep your coffee cups on the table.)

Anonymous – I wouldn’t frame local and state taxes as “just”. Economic analyses have found that the majority of taxes that are paid are these local and state taxes and fees. These take out a lower proportion of middle, lower, and impoverished people’s real net income than all of the taxes and fees (federal, state, and local) paid of the top 5%.

Republicans don’t have a good history(or memory)of making the American economy work well. Even one of their gods with feet of clay, Reagan, raised taxes. Fixing problems created over the past 12 years only works when ALL parties come to the table with one agenda, helping ALL Americans, not just their friends and contributors.

Starluna, sorry about the “just”. I realized it after, but Max was saying we should lower the tax on the lower income. We’ve already done that. they pay through sales tax and property taxes (in their rent) Many people have posted that all should pay some Federal Tax. I disagree totally. Less fortunate are paying enough tax.

And Max, Obama specifically fought to extend Bush’s tax cuts for those people making under $250,000. Republicans refused unless he extended them for everyone (including the rich). So saying Obama didn’t push it is completely false.