Former Secretary of Labor Robert Reich has an excellent article in the NY Times about the rather direct correlation to how well the middle class is doing to how well the economy does. (Memo to supply-siders: trickle down economics does not work, and has never worked. It is, as George Bush Sr. put it in 1979, “voodoo economics”).

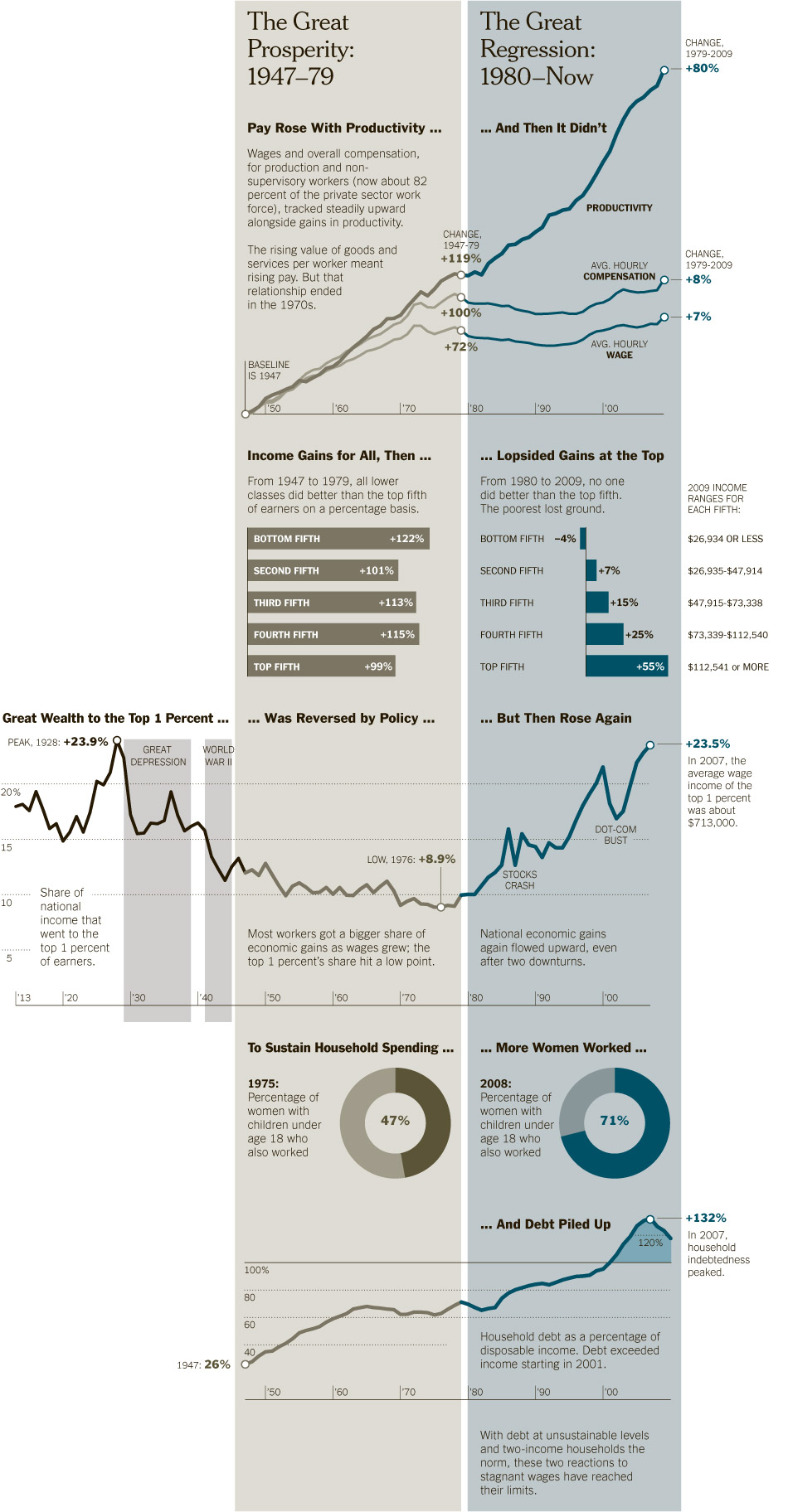

When the gap between rich and poor has gotten larger, the economy has suffered. But when the rich take a smaller cut of national income, the economy does much better. In fact, even the rich do better when they share the wealth — they may get a smaller slice but it is a far larger pie. The extent to which this is true is made evident by the following infographic:

Note in the first graph, productivity has been growing steadily with the exception of a small hiccup in the late 70s (mainly caused by the spike in oil prices). But when we came out of that hiccup, something changed. While productivity resumed its climb, wages and compensation for workers went flat.

The second graph shows that after 1980 (and the advent of trickle-down economics) the top income earners did indeed receive most of the productivity gains, while the poor saw their income go down. But even so, the rich only saw gains of 55%, compared to 99% prior to 1980.

But that’s not the biggest problem. In the third graph we see that when the gap between rich and poor is large, the economy suffers. This happens because the middle class is the driving force of a consumer economy. Spending for the rich is much more discretionary, so when the economy starts to go down, the rich stop spending, which causes the economy to get worse, and so on in a huge downward spiral.

In fact, the only reason our economy was able to keep growing even though middle class wages were flat after 1980 is because of two things: as the fourth graph shows, more women entered the workforce (the number of married women with young children who worked was 12% in the 60s, but soared to 55% by the late 90s); and as shown in the fifth graph, household debt climbed to unsustainable levels, peaking at 132% of annual income in 2007 (when the housing bubble crashed).

Since neither of those can increase much more, spending by the middle class can only go down, starving our economy of the fuel it needs to grow. There is only one solution — we need the rich to transfer some of their wealth to the middle class in order to fuel economic growth. Ironically, this will reward the rich far more than if they selfishly tried to hold onto their money.

7 Comments

While I agree with the sentiment overall, there is one problem with this analysis: It ignores the unique historical circumstances of the 1947-1979 period. In the post-WWII period, the rest of the world economic powers were rebuilding basic infrastructure and couldn’t compete with the American business juggernaut. That is, we didn’t face the same type of international competition that emerged in the ’80s and ’90s. So the suggestion that the trends of 1947-1979 were sustainable is disingenuous.

Having said that, screw Reagan, Norquist, and all the other trickle downers for making the situation dramatically worse than it would have been.

Interesting thought. My question would be, why was it the way it was?

You seem to say that our economy exploded because other nations were rebuilding after WWII, but then somehow they caught up and surpassed us starting with the 80’s.

If we ignore the effect of trickle down and Reaganomics (or more accurately, we assume for a moment that it didn’t have a negative effect on us), how would it be possible for the rest of the world to catch up and surpass us, considering the measurable head start we had?

I would think if the blame didn’t lie with trickle down, we’d have continued to dominate markets with ease…right?

There probably needs to be an international comparison in order to address Micheal’s claim. While there may be merit to his claim, there may also very well be some problems with the assumptions that underlie it.

First, the trends showing changes in inequality relative to tax structure have little to do with who is a global economic power. If the relationship between redistributive tax policies and inequality is valid, it would apply to small economies as well as large economics (at least in the general). Moreover, the claim about who was rebuilding primarily applies to Europe. Latin America was not destroyed during WWII and Australia also did not suffer to the extent of Western Europe. While much of Latin America was under the thumb of Western supported military dictatorships or emerging from colonial oppression, in this period Mexico was not and it is (and was even at that time) a capitalist country. So, it would be interesting to see the level of inequality as related to tax structure in those countries in that time period.

Also, post-1980s, when (as Micheal asserts) all countries were competing more equally (or at least everyone was facing competition), we would need to see what were the levels of inequality relative to tax structure around the globe. If it turns out that other countries, who faced the same global competition that the US did, had a more redistributive tax structure and less inequality overall, then the potential economic uniqueness of 1950-1980 may not actually be as relevant as assumed.

But, we’d need to see the numbers.

I’m not sure I agree with Michael’s point. As the first graph clearly shows, productivity kept on growing post-1980, so the economy itself was doing fine. It is just that wages flattened.

Now, you could make a point that wages flattened in order to compete against other countries were wages were lower (cough, China, India) but we lost that battle anyway, and yet productivity kept on growing.

@1032, “If we ignore the effect of trickle down and Reaganomics…how would it be possible for the rest of the world to catch up…” I wasn’t suggesting that we ignore the impact of Reaganomics. My point was simply that Reaganomics wasn’t the only factor involved. The world is always more complex than that. The rest of the world could have caught up in many ways. Their engineers could simply study our products and innovate. Our industries (I’m thinking of auto) could have become complacent and stagnated. I’m just saying that it is overly simplistic to place the entire blame on a single factor, though that factor clearly had an influence.

@Starluna, yes, the claim about rebuilding applies primarily to Europe and Japan, because that’s where the major world economic powers have been before and after the war.

In addition (and this also goes to IK’s point), there are other economic measures that are missing here. Yes, productivity rose. However, increased competition (i.e., increased supply) has a downward pressure on prices. So even though the number of units continued to grow, we must also see the trends in measurements like the CPI and international numbers, which are both missing.

“…but we lost that battle anyway, and yet productivity kept on growing.” Productivity is not necessarily measured in physical units, but in GDP per hours worked. So it is possible for China to push manufacturing wages lower here while our productivity continued to increase.

I never meant to suggest that Reaganomics had no effect on inequality. I am simply arguing that many of us on the left have rosy colored economic glasses when we look at the 1947-1979 time period. It’s as if, if we somehow returned to the policies of that era and kept everything else about the modern world the same, the compensation line would magically jump up to match the productivity line. Yes, changing our policies to be exactly the way they were almost definitely would help the equality measures. But other measures, such as GDP, might not fare as well in the face of increased international competition.

Michael – I think the argument here is not so much concerned with macro-economic measures like GDP, but that less inequality through redistributive tax policy does not harm – and in fact helps – the wealthiest individuals and families. It also happens that productivity also does not decline with less inequality, as trickle-down proponents argue. But that is really a nice side issue to the real issue of inequality.

I think that international competition was not the factor that changed the curve – it was computerization of businesses and homes, which really took off starting in 1980 with the introduction of the PC. Computerization broke the connection between productivity and human labor.

It is also true that only thanks to real time communications and reporting across the globe did outsourcing become popular – with no computers you didnt have enough control to give all your work to people in China. Now you get real time reports on what they are doing.

International competition has definitely impacted the job destruction in the US, but the change in the productivity curve is due to technology.

One Trackback/Pingback

[…] history demonstrates that the wealthy will be better off when the less wealthy are better off since A Rising Middle Class Tide Raises All Boats. O’Rourke’s quick wit is well suited for … ummm … wait … hmmm … wait … don’t tell […]