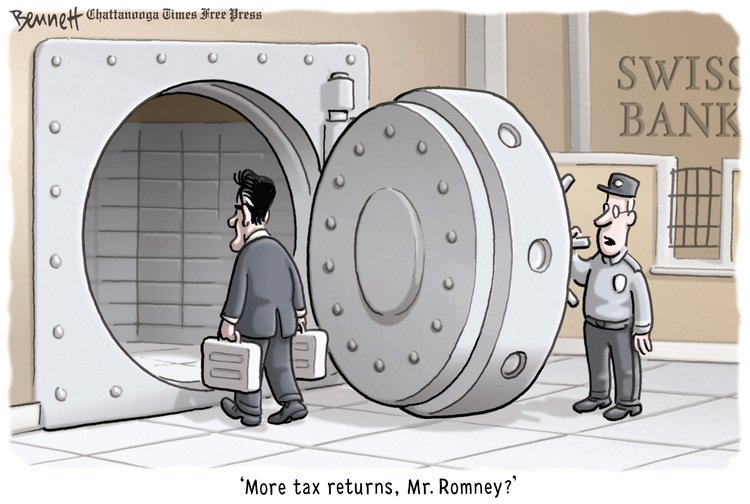

So, why is it that Romney is so adamant about not releasing his tax returns? He doesn’t seem like the kind of guy who is embarrassed about being rich. So it seems safe to assume that he is deliberately hiding something.

One theory concerns the fact that back in 2009, the IRS did a massive crackdown on the use of overseas bank accounts as tax havens and offered amnesty to anyone who disclosed those accounts. This happened when Switzerland’s largest bank was forced to reveal the names of its US account holders. The theory is that Romney took advantage of that amnesty, which means that if he revealed his tax returns, they would reveal that Romney was — at the time — illegally avoiding taxes. Even though the IRS granted amnesty, the US taxpaying voters might not be so kind.

Indeed, even though Romney claims to have released his 2010 tax returns, even then he didn’t include all of his tax forms. Specifically, he didn’t include the forms documenting his Swiss bank account (and his financial activities in Bermuda and the Cayman Islands).

So we really have no idea why Romney had a Swiss bank account. Was it to avoid paying taxes? Was it to avoid disclosing investments that would embarrass him? Unless he shows us this form, we may never know.

For their part, the Romney campaign has explicitly said that the Swiss account that we do know about was not part of the IRS amnesty program, but that doesn’t mean much, since there could have been other Swiss accounts that we don’t yet know about.

For a good summary, The Atlantic has a fun article that goes through the various theories as to why Romney will not release his tax returns, offering evidence both for and against each theory. Not surprisingly, all of them are good reasons for Romney to want to avoid releasing further tax information.

I’m surprised that nobody has speculated that the Romney campaign is deliberately laying a trap. Get the Democrats to focus on Romney’s tax returns until speculation goes completely overboard. For example, by having someone tell Harry Reid that Romney paid no taxes for 10 years. Then, when Romney is finally “forced” to reveal his returns, there is nothing in them that is even half as damaging as what Democrats claimed, and the whole thing blows over. Maybe some of the stuff in the tax returns is damaging, but a good way to mitigate that damage would be to entice the Democrats to overplay their hand.

5 Comments

Iron, I been thinking same thing for a while. This would be his October (or perhaps September) surprise. He would release it at right time, and then start pounding democrats and Obama on wasting time on his tax returns rather than fixing economy etc

I’ll always be a Romney taxes truther!

About nothing being wrong with Mitt’s taxes and this being a plan to embarrass the left, I remember reading on businessinsider or washingtonpost about that strategy a few weeks ago.

That doesn’t make sense to me for the following reasons:

1) Instead of focusing on the economy, which is pretty shoddy to say the least, everyone is back to focusing on Mitt and his wealth. I would say that’s not what Mitt wants.

2) Reading about his Cayman and Swiss accounts makes me think there is no way there is nothing embarrassing on his tax returns. There has to be something which shows that he had an unfair advantage due to some loophole in the tax system.

Putting this issue on the front page serves Mitt no purpose. He may pull a rabbit out of a hat and his tax return could be normal and pigs could suddenly fly. However he would have wasted valuable time in which he could have focused on all of Obama’s shortcomings which are several.

One aspect that I’m surprised has never come up in any of these theories is the religious aspect. Mormons are supposed to tithe 10% of their income. If his tax returns revealed that he was tithing at a lower rate, there could be repercussions with him in the church, as well. I have no evidence for this suggestion (ugh…I feel like a Fox News sleaze…). However, I’m surprised this has never come up in any of the theories that are out there.

Breaking from Newsmax.com

Experts: Romney No-Tax Scenarios ‘Plausible’

Senate Majority Leader Harry Reid’s allegation that Mitt Romney went a decade without paying federal taxes has outraged the Republican’s supporters. But is it even possible? Tax experts say maybe.

Talking Points Memo decided to consult tax experts after a reader pointed out that Romney’s severance from Bain Capital could have been routed directly into a tax-exempt IRA. That would have shielded it from taxes for years, and lowered Romney’s tax rate dramatically, the reader said.

(Arthanyel note – that would explain the $100M IRA)

Ed Kleinbard, a tax law professor at the University of Southern California School of Law, told the TPM website it’s highly unlikely that Romney paid absolutely nothing to the Internal Revenue Service. But if Bain bought company shares back from Romney’s IRA, that money wouldn’t show up anywhere.

“What’s in the IRA is invisible on the return,” Kleinbard said.

To owe no federal taxes, Romney would have had to avoid other income sources or found ways to erase the tax rate on that income.

“We know that by 2010, he had lots of other income,” Kleinbard said. “He had something like $20 million in other income. … What [the TPM reader] wrote may be true but it has nothing to do with the $20 million on the return in 2010.”

Daniel Shaviro, a tax expert at New York University, said it’s possible that Romney could have used his IRA to avoid realizing capital gains on his Bain shares. This could have helped him accomplish what is known as loss harvesting — when investors sell off financial losers to cancel out capital gains elsewhere in their portfolio.

“It struck me as plausible,” Shaviro told TPM. “The reason people have been saying he must have paid something is that they’ve figured he must have (as in 2010) had some dividend and interest income plus other ordinary (rather than capital gains) stuff such as speaker fees. Zeroing all that out, if he had such income every year, would have required tax shelter losses that would very likely be deemed (by the IRS and many legal experts) as abusive.”