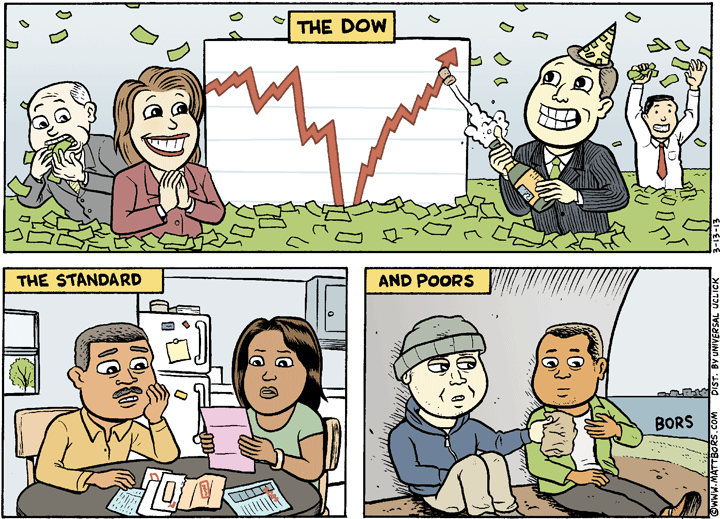

I don’t know why, but every time something financial keeps going up and up, despite there not being any particular reason for it doing so, I keep thinking that it is just another economic bubble about to burst. Have I really become that jaded? Or am I just one of the only sane people left?

Well, at least I’m not alone. Here’s a comment left on the above comic:

This is what happens when we have a demand side economic problem, persisting for several years, and the Federal Reserve keeps increasingly pushing supply side easing. The low interest rates, and now third round of bond buying keeps is supposedly pumping gobs of money into the system in the hopes of stimulating the economy. The problem is that the problem is not on the supply side. Banks have money to loan but aren’t loaning it. Businesses don’t need to expand to meet demand, so they are not expanding, meaning no jobs are being created. Both are looking for some place to stash all the cash that they have become bloated with and it is currently going into the stock market. This is what is driving the DOW up. It is yet another artificial bubble. The consumer of course gets to hold the damned empty bag by paying for it through inflation, which only exacerbates the demand side problems.

What I don’t get is why is it considered acceptable to give all this money to those entities who already have too damned much and are absolutely choking on it, but not to give any to those who desperately need it? Why is it considered acceptable to spend billions of dollars in foreign countries to aide them, yet here we’re cutting off unemployment benefits when people can’t get jobs. Unemployment figures down doesn’t equate to employment being up. In this case it is indicates the ranks of those who’ve fallen off the list and probably into despair.

If money were injected in at the bottom of the economy, it would work its way up through the supply chain, with the effect compounded several times over. When it is injected at the top, only a small fraction makes its way down and now, even that isn’t happening.

Remember the cash for clunkers deal? What was probably the most short lived of all the economic stimulus ideas and the one most loathed by those in power? It had an effect up and down the supply chain, from the consumer all the way to the steel mills.

Eventually this bubble is going to burst and when it does, look out below.

I totally agree.

6 Comments

I believe it is overvalued as well. Fair value, I think, is more around 12500-13000. Considering we have a recession every 7 years or so it isn’t that bold to think things are going to head downward.

Raising the minimum wage could stimulate the demand side.

I’m a Progressive, so personally I like the idea of the governments (Fed, State, County, etc) hiring people directly to work on our infrastructure (human and physical: teachers and nurses to construction), and reworking the tax code pretty severely so that the wealthy pay for it.

It’s not going to happen in our political climate, of course. But when I look at crumbling bridges, over-packed classrooms, and elderly in need of medical care that’s more than a 15 minute visit, I can see where all that extra cash held by banks / corporations need to go.

And spending it among the poor and middle class, and for services and goods shared by all, would actually stimulate the economy on the demand side.

I see a problem with how we measure the health of the nation. GDP should no longer apply. When companies use overseas engineers to design products, overseas factories to build them, and then sell the products overseas, their profits go up. This pushes up the GDP and has no affect on the health of the nation other than some of that money going into the pockets of the board of directors and maybe a few stockholders. Our country isn’t improving because the GDP is rising, nor consequently because of the DOW going up. We need to find metrics that focus on the citizens.

Because giving money to poor people is socialism.

Also it should be known the DOW isnt a very good indicator for the economy. S&P 500 is much better

The stock market has become a wealth generating factory instead of what it was designed to do, finance the rest of the economy. Some will get wealthier and get out just before the bubble bursts, leaving the rest of us picking up the tab.

Yes, Iron Knee, you are not the only one that thinks it’s a bubble, the market has become an interment of transferring the wealth of the many into the pockets of the few.

Down with the Plutocracy, Down with voodoo economics, end corporate personhood.

I used to be a moderate Republican, but those don’t exist anymore, so I guess I’m a radical Progressive that thinks the government should end welfare to the wealthy.