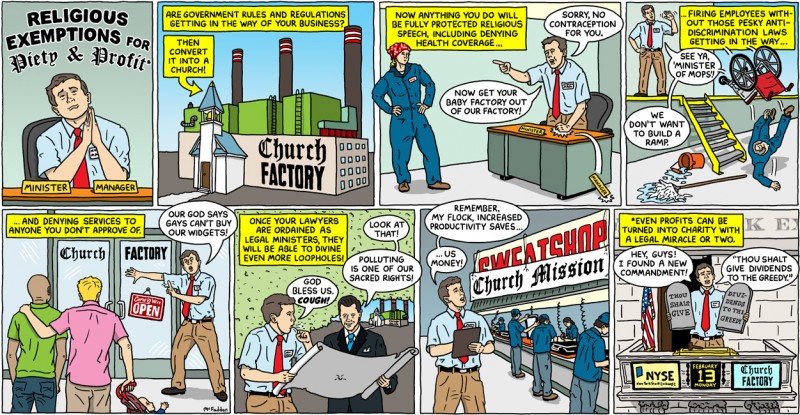

I’m definitely not anti-religion, but it seems crazy to me that we give huge (as much as 100%) tax breaks to churches to run normal businesses, and they even get to make profits. Doesn’t that violate the establishment clause since it allows the government to decide what is a religion, and then based on that decision give the religions they like gross preferential treatment? Churches in this country already own radio and TV stations, newspapers, financial and securities corporations, insurance companies, restaurants, hotels, universities, water and sewer companies, banks, farms and ranches, shopping malls, and book publishers. Things like church-owned hospitals should be treated like any other charity or non-profit corporation.

-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

8 Comments

Don’t forget all the “ordained” ministers (self annointed or otherwise). They all get tax exemption on their “church” that resembles a home and business write off for their cars. I think to qualify for church status you need to have some criteria met, like have an alter like structure, perform some type of regular services, and requalify that entity annually.

In the medium/large city close to where I live they bring up the complaint that about 1/3 of the city claims the “tax exempt” status due to religious affiliation including many of the examples you site ie. hospitals, etc and non profit institution.

Virtually every hospital in my area is either a non-profit or religious entity. The city then wonders why tax revenue is falling. They increase taxes on those that are left to pay and then wonder why the city has shrunk by 25% over the last 20 years (thereby reducing the tax base and causing the to further raise tax on those left who are not a tax exempt).

It creates a downward slide that perpetuates itself. Now the majority of people left in the city are A) tax exempts or B) the poor who don’t pay that much in tax. Those able and available to pay are disappearing and the city doesn’t seem to know how to correct the slide.

I’m guessing they are not the only metropolitan center to experience the same situation.

Really, we need to throw out the entire tax code and start over eliminating all tax breaks and loopholes. Create a prgressive flat tax system and then carefully, very carefully add those exemptions that are both fair and beneficial to all. Perhaps requiring like a 2/3 majority to add it back on. Then we need to look at “fee’s” that cleverly replace taxes although thats exactly what they are.

I was totally with you until you said “progressive flat tax system”. Ignoring that your phrase is an oxymoron, why would fixing our tax system require it to be “flat”? And don’t tell me because it is simpler, because that is not the complicated part.

As a member of the ordained clergy in a national denomination, I can tell you that I work hard to assure that everything my church does falls within the mandates that make us tax-exempt. We do not pay property taxes on the primary building, which houses our sanctuary, classrooms, and fellowship area, but we do pay market rates on the parsonage, which is my home. We have very strict rules to follow for all of our fundraising efforts, meaning that the proceeds have to be accounted for at every step and used for the mission/ministry of the church (which includes FICA, salaries and benefits for paid staff…well, salaries for 4 of us and benefits for me as the only full-time staff member) or the group within the church operating the fundraiser. We are not allowed as a church to endorse any political candidate, though we are allowed to educate our membership about issues from a faith perspective – and I really hope the IRS comes down HARD on churches which violate this distinction.

As far as I’m concerned, any religious institution which does not have as its PRIMARY purpose corporate worship should be considered a secular non-profit organization for purposes of employment regulations and taxation. That includes schools, camps, hospitals, and judicatory offices. There may be other special categories such as educational non-profits, in which these institutions fall, in which case that should be the operating category.

Fun Rev, I think we agree, although I hope “corporate worship” was a typo on your part.

I will admit that I don’t know the tax law concerning churches, so can someone enlighten me as to how churches are treated differently than other non-profits (and if possible, why)?

IK – the “progressive flat tax” PSgt mentioned is a shorthand way of saying eliminating most (or all) deductions and exemptions and setting a simple fixed rate in tiers based on income.

I think that’s the right general idea, but I do think there are some exemptions and deductions which are fair (like almony comes off your income and on to your ex-spouse’s, or having extra dependents like I have to take care of my father in law) and some which are simply too important to too many people to unwind (like the mortgage interest deduction).

The said, a MUCH simpler tax codes with fairly simple tiered fixed rates is the right idea.

IK – Arthanyel is correct in what I was trying to say (he just said it better).

I think if we had 3 flat rates, say 5, 15 and 25% with income brackets for each and eliminated 95% of exemptions it would be a fairer system. I also agree that if we were to eliminate the most favored exemptions of say mortgage interst it would be a tough pill to swallow not only for wealthy but for middle class. Perhaps there could be a matching deduction for interest meaning if your in the 5, 10 or 25% bracket you can deduct either the amount of mortgage interest of the bracket your in, either 5,10 or 25%. Most people in the 5% bracket would probably not have mortgage interest any way, but it would continue to provide incentive for people to purchase property. I’m sure their are other good ideas that could work. I’d also be in favor of the alimony transfer, being deductable from the providers income and adding to the receivers income. I think thats fair as well.

Ah, ok I’m with you. Every time I hear someone mention the flat tax, they seem to want just 10% for everyone, which is not progressive. Or worse, like Herman Cain’s 999 plan, they want 9% for all individuals, 9% for all businesses, and a 9% national sales tax — doubly regressive!

The problem with the mortgage interest deduction is that it inflated the prices of homes to compensate. People bought houses not based on the price of the house, but on how much they could afford to pay each month (taking into account the interest deduction). So in the end, the mortgage interest deduction did not help anyone purchase property — it just made the housing bubble worse and enriched realtors whose commissions were based on the price of the house (which means it actually cost buyers and sellers more, which would naturally discourage home ownership, the opposite of what was intended — funny that).

Of course, it is too late now. If we eliminated the mortgage deduction housing prices would plummet and even more people would be under water and not be able to afford their monthly payments.

I would love to eliminate the mortgage interest deduction, but I don’t see any way to do it (politically or economically).

Of course, what I’d really like to do is eliminate all personal income and sales taxes, and replace them with taxes on things we actually want to discourage, like carbon taxes and taxes on pollution and the usage of other finite natural resources. We want people to earn money and spend it, so why do we tax those activities? We should only tax things we want to discourage.

Well, they’ve been taxing the heck out of cigarettes for a while now, but I havn’t seen the # of smokers decline much in that time. Seems to be stuck around 25%. Of course if they really wanted to improve peoples health they would ban cigarettes all together, but won’t because of the tax they get o one end and the contributions they get on the other. The poor smoking bastards are stuck in the middle. My state also taxes gasoline (a flat tax plus a new % tax) and alcohol, and pooh (not winnie).

I don’t see the cowards in congress tackling tax reform any time soon. After all , what would lobbyists want to bribe them for if loopholes are eliminated.