-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

5 Comments

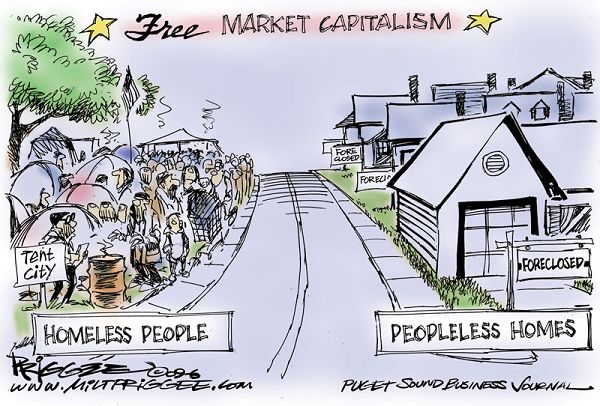

This whole cartoon is built on the logical fallacy that the housing crisis was caused by free market capitalism. For those who actually care about the facts and not just political gameplay- free market capitalism does not support a central bank (such as the Fed), it does not support GSEs (such as Fannie and Freddie) and it does not support the government getting involved in the markets and forcing certain market outcomes like the government did in the decades leading up to this meltdown.

Personally, I’m a capitalist (see the “About” page for more information), but I think that the term “free market capitalism” has become an oxymoron. You cannot have any market without getting government involved. So the only question is — how much government involvement. I tend to agree that we have had too much government involvement in some markets, but ironically it has been the same people who scream for “free markets” that have promoted the largest government involvements in those markets. On the other hand, if governments weren’t involved in some degree with the markets, they would devolve into rampant greed and robber barons. Markets have to have rules, and market players themselves are horrible and either coming up with rules or enforcing them.

Postulate 1: The only valid role of government in the marketplace is the preventntion of FORCE and FRAUD.

Postulate 2: Virtually all large-scale problems and failures in the marketplace can be traced to some combination of the following three causes (complicated by the Law of Unintended Consequences, of course):

a) abdication of personal responsibility;

b) people believing they can get “something for nothing”;

c) government intrusion into places not authorized by Postulate 1.

The fundamental root cause of this mess, in my admittedly uneducated opinion (I have no education beyond high school except for the technical training I received as a nuclear operator in the Navy), is the shareholder detachment created by the existence of mutual funds and large pension funds. Before the meltdown, virtually all large funds held roughly 10% of their value in financial stocks, and the shareholders in those funds are essentially anonymous. The fund managers only cared about the bottom line, and would shift stocks at the drop of a hat. This effectively eliminated the “shareholder conscience” concept from the equation, communicating loudly and clearly to the boardrooms of those mega-banks that the bottom line was all that mattered. Thise boardrooms listened.

Bubblehead, I think the problem with Postulate 1 is that it is simultaneously too limited and too broad. Too limited because it is appropriate for the government to do things like issue money. Too broad because it is not difficult to justify basically everything bad the government has done in regulating markets as the prevention of force and fraud.

Personally, I think the biggest thing we could do to clean up markets in general would be to 1) revisit corporate personhood and 2) strongly enforce our existing anti-trust laws.

I don’t know, I find it really hard to twist Fannie Mae and Freddie Mac around into being compliant with Postulate 1 … and I don’t see how GWB’s “zero-down HUD loan” home-ownership initiative in January 2004 qualifies, either …

I’d really like to revisit the concept of mutual funds. I think they are extremely harmful to the marketplace. People invested in the funds abdicate the responsibility of exercising shareholder oversight of the companies they own shares of, since they own those shares at arm’s length, so to speak. So they think they can get the benefits of holding an equity position without any need to undertake the responsibilities of ownership. Then those very same mutual-fund shareholders wax remonstrative and View With Alarm the fact that corporate executives seem to be focused purely on short-term profits rather than responsible long-term management and “corporate citizenship”.