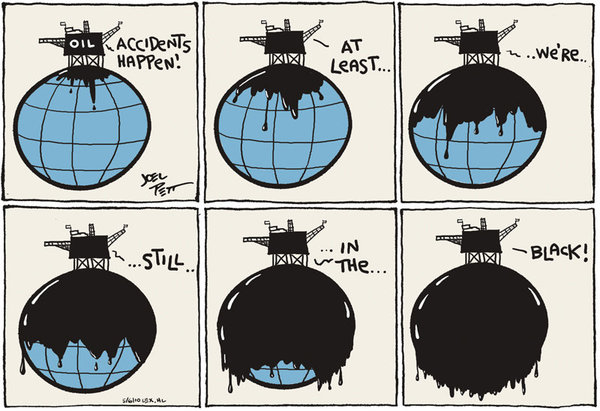

What’s slicker than an oil spill? How about oil companies that make billions in profits, don’t pay any US taxes, and still get the government to help pay for their accidents.

-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

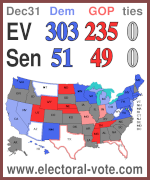

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

2 Comments

Let’s be fair. The oil companies do pay taxes in the US – and specifically they pay a tax into a fund set up to provide help in cleanup: The Oil Spill Liability Trust Fund (OSLTF)

The Trust Fund money comes from:

•Barrel Tax. The largest source of revenue has been a 5-cent-per-barrel tax, collected from the oil industry on petroleum produced in or imported to the United States. The tax was suspended in July 1993 because the Fund reached its statutory limit. It was reinstated in July 1994, when the balance declined below $1 billion, but expired at the end of 1994 because of the sunset provision in the law. The 2005 Energy Policy Act again reinstated the tax (effective April 2006).

•Transfers. A second major source of revenue has been transfers from other existing pollution funds listed above. Total transfers into the Fund since 1990 have exceeded $550 million. No additional funds remain to be transferred to the OSLTF.

•Interest. A recurring source of OSLTF revenue is the interest on the Fund principal from U.S. Treasury investments. As a result of historically low interest rates, interest income declined in 2003 and 2004, but has rebounded in recent years as Treasury rates have risen with the economic recovery. The Department of the Treasury serves as the OSLTF’s investment manager.

•Cost Recoveries. Another source is cost recoveries from responsible parties (RPs); those responsible for oil incidents are liable for costs and damages. NPFC bills RPs to recover costs expended by the Fund. As these monies are recovered, they are deposited into the Fund.

•Penalties. In addition to paying for clean-up costs, RPs may incur fines and civil penalties under OPA, the Federal Water Pollution Control Act, the Deepwater Port Act, and the Trans-Alaska Pipeline Authorization Act. Penalty deposits into the OSLTF are generally between $4 million and $7 million per year.

Ultimately the oil companies provide the money to the federal government to pool against just this kind of event. It’s perfectly reasonable to expect the fund to help pay to assist in the cleanup – that’s precisely why it was created

Quiddam – this is true. But under the Oil Pollution Control Act that set up this fund, the leaseholder of whatever caused the spill is responsible for any costs associated with the cleanup, regardless of the amount available in the OSLTF.

Currently, the maximum size of the fund is $2.7 billion. The clean up of this spill is estimated to exceed this. BP is required to cover the costs of cleanup that go beyond the billion dollar limit per incident.

The law also does not prevent those who believe they were fully compensated for their losses to sue BP in civil court. That process, as we know, usually takes forever. And indeed, that is the main purpose of these funds. Because it takes so long for these issues to get resolved in the courts, these kinds of Funds allow the government to compensate folks economically harmed by oil spills and then get reimbursed (or fine the hell out of) the companies responsible. The purpose of the Fund is not to take away financial responsibility from those who caused this disaster.

With that said, there’s a lot of dispute about how this law will apply to this oil spill. It has never been used for anything of this magnitude before. There is movement in Congress to raise the liability cap currently in place in the use of these Funds and to redirect the money to those directly affected rather than having the money go through the companies responsible for the spill. We’ll see what happens.