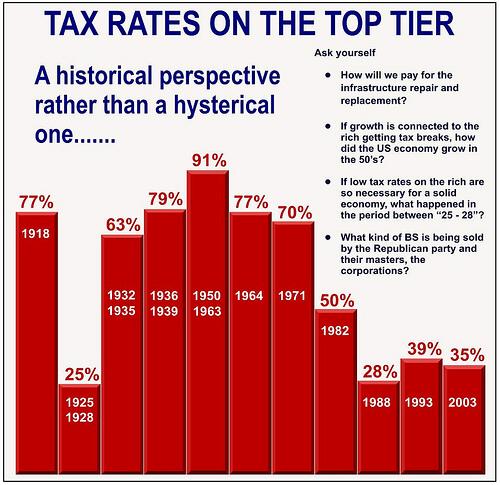

Maybe, just maybe, when the top tax rate goes way down for the rich, they use their excess money to fuel some stupid bubble. Because the theory that cutting taxes for the rich helps grow the economy just doesn’t seem to be working out in practice.

UPDATE: In fact, there is a good argument that when taxes for the rich go up, the economy gets better for everyone (including the rich).

8 Comments

The figure in this post was emailed to me, and I don’t who who the source is. If anyone knows where it came from, please let me know so I can give them proper credit.

Not sure where this chart came from but a quick “google” came up with this site-

http://www.docudharma.com/diary/18211/historical-income-tax-rates-for-the-top-tax-bracket-with-charts

which, not only gives the highest rate, but also at what level you start paying it- which is critical for the “big picture.” That blog listed its source as the National Taxpayers Union:

http://www.ntu.org/tax-basics/history-of-federal-individual-1.html

which lists its Sources: Joint Committee on Taxation, “Overview of Present Law and Economic Analysis Relating to Marginal Tax Rates and the President’s Individual Income Tax Rate Proposals” (JCX-6-01), March 6, 2001, and Congressional Research Service, “Statutory Individual Income Tax Rates and Other Elements of the Tax System: 1988 through 2008,” (RL34498) May 21, 2008.

Thanks DAN, that’s exactly what I was going to ask.

Interesting to note from the link that the top bracket has basically been fairly constant and no higher than it was in ~1965.

Other interesting information (of many) to know would be the use of loopholes and the rates of tax evasion during these times.

Interesting that two of the worst recessions started during the time we had two of the lowest tax rates. I think discontinuing the tax cuts for the high earners would gain more support if Obama offered tax credits in some other form ie keep the tax rates where they are now but offer credits for investments so that the money is actually put to good use instead of being wasted.

1st Dan – thank you for that link. I plan to print those out and tape them to my office door.

Jonah – I noticed the same thing. I like your suggestion and would go further by tailoring the investment credits to green development, non-polluting, or health supporting technologies. More credit for investing in windfarms and less for investing in oil drilling.

Thanks Dan 1 for the links!

I’m glad other people noticed that every time the tax rates on the rich go way down, the economy goes into the toilet. That doesn’t prove causality, of course, but my argument is that it encourages bubbles — like we are seeing now — as the rich chase things to invest in.

Again, contact your representatives. Let the people’s voice be heard.

I am shocked after see this,its horrible for the economics

One Trackback/Pingback

[…] PoliticalIrony […]