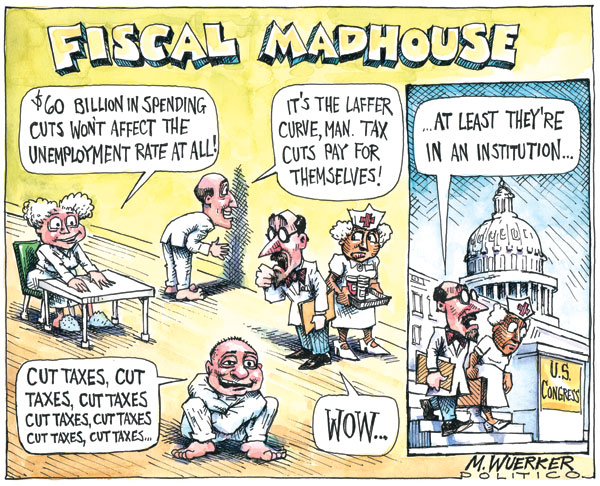

Not to mention the state of denial it takes to completely ignore spending cuts for the military and for entitlements.

-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

12 Comments

The IRS returns $10 for every dollar of cost. Now the Republicans want to cut their budget, too.

http://www.washingtonpost.com/wp-dyn/content/article/2011/03/01/AR2011030104721.html

I agree IK on the state of denial for cuts to entitlements. To follow is a link to the treasury’s budget accounting for income and dispersments for 2010. It has some rather eye opening information. The number 1 highest spender is now HHS which handles medicare among other things. They spent $854.1 billion 50 billion less then what we took in from income tax. They were followed by the #2 biggest spender….Social Security which spent $754.2 billion. Coming in third for the first time in a while was (Ta Da) DOD at $666.7 billion.

What is alarming is revenues were up in both individual income tax and corporate tax. We took in 1 trill, 90 bill between these 2 and combined with the other incomes a total of 2.162 trillion. With all that income we still ran a 1.6 trillion deficit. WOW!

All this means we could defund HHS and DOD and balance the budget or HHS and SS or SS and DOD, what’ll it be.

read it and weep:

http://www.treasury.gov/press-center/press-releases/Pages/tg911.aspx

“Social Security which spent $754.2 billion.”

Social security pays for itself. It’s based on a separate budget.

“Coming in third for the first time in a while was (Ta Da) DOD at $666.7 billion.”

Defense cost over $1 trillion. Trillion. The number you quote doesn’t include Afghanistan and Iraq.

“What is alarming is revenues were up in both individual income tax and corporate tax.”

Actually, income tax rates and corporate tax rates are very low compared to historical norms.

Low corporate tax rates are especially dangerous to the economy, because it encourages corporations to take our revenue in the form of profits. Higher taxes means it is wiser to re-invest profits as R&D, expansion, etc.

“All this means we could defund HHS…”

Which would kill the economy. A healthy workforce is a productive workforce. Hell, if the government just said, “Everyone’s part of Medicare.” they would save money.

“All this means we could defund HHS and DOD and balance the budget or HHS and SS or SS and DOD, what’ll it be.”

Or you could raise taxes on the rich, corporations, capital gains, inheritance, etc. back to the levels they were under Bill Clinton. You know, back when the economy wasn’t in the shitter.

Absolutely CSS. I would have loved for Obamacare simply to have been Medicare for all. I think he might even have had less of a fight for it, since even the Republicans claim to love Medicare. And yes, I would gladly have paid higher taxes for it.

I really liked the system they had in New Zealand when I lived there — basic health insurance for everyone provided by the government, but you were free to purchase fancier coverage if you wanted.

CSS – They are not my quotes they are the treasury’s numbers. I do agree with you and IK that we could have done healthcare a different way and funded it through an existing program. I’ve also looked at NZ’s model and it looks good and could be alot easier to implement then what we have. Also I have been an advocate for completely doing away with the Bush tax cuts, but with one precondition that Gov’t show some fiscal responsibility first. Let them cut 2/3 of the deficit( back to Bush Levels), and then taxpayers, corporations can take care of the rest and apply the remainder to reducing the debt.

Here’s another site that compares all the spending and budgets from 2006 to current in simple to read charts.

http://www.federalbudget.com/

I have been having a running debate with someone on a liberal blog about entitlement reform. The math is simple – if we don’t change anything with do with Medicare, Medicaid, Social Security and welfare programs the country will go bankrupt eventually – even if we slash defense spending to be more “right sized”. That said, there are a lot of changes that we can make that don’t include just denying benefits to people in need.

Many Republicans seem to be actually Libertarian, in that they don’t want to pay for anything they personally don’t use. Unfortunately if we took that approach we wouldn’t have interstate highways, national parks, or still be a free country, so I think people need to just accept that we all have to contribute something to the society as a whole, and the only real issue is to make sure that contribution isn’t completely unfair.

Speaking from persdonal experience, a family that makes $250,000 per year or more, or an individual that makes more than $200,000, can afford to pay a little more.

Agreed Jason – the problem as i see it is any worthwhile sooending cuts will be viciously opposed by the left politicians, not necessarily left voters. Also, I thinkthere is a sentiment among the majority of Americans (as there was in 94) that they would be willing to pay more, but they want to see congress act responsibly first. Lets see some honest initiative from our elected representitives then myself and other will get out our checkbooks.

“the state of denial it takes to completely ignore spending cuts for the military and for entitlements”

Seen Rand Paul speak lately?

“The math is simple – if we don’t change anything with do with Medicare, Medicaid, Social Security and welfare programs the country will go bankrupt eventually…”

But the changes that are being talked about will make the situation worse.

Medicare / Medicaid / Social Security / Unemployment / Welfare actually help the economy, because they help people stay active members of the economy when they otherwise might slip between the cracks. A stronger economy means more tax revenue.

About 40% of personal bankruptcies are due to medical costs and happen to people with insurance. People who go bankrupt hurt the economy.

Secondly, the United States is no where near bankrupt as a whole. Interest rates are at low compared to historic norms. A country is not in real financial trouble till it has trouble securing loans.

Thirdly, taxes are also at the low end of historic norms.

Here’s my plan:

1.) Treat capital gains, inheritance, etc. as income and not some special category.

2.) Increase the number of tax brackets and make the income tax much more progressive.

$250,000 = 35%

$500,000 = 37%

$1 million = 39%

$2 million = 41%

$5 million = 43%

$10 million = 45%

$20 million = 47%

$50 million = 49%

$100 million = 51%

$200 million = 53%

$500 million = 55%

$1 billion = 57%

$2 billion = 59%

$5 billion = 61%

$10 billion = 63%

$20 billion = 65%

$50 billion = 67%

And so on. Eventually you will hit more than 100%, but not before you hit more money than there is in the world. Every once and a while drop all brackets by 1%, to compensate for bracket creep.

3.) Raise corporate taxes back to where they were in the 1990s. Low corporate taxes encourages high profits, while high corporate taxes encourages reinvestment into the company. You can guess which is better for the economy.

PSGT: “…the problem as i see it is any worthwhile sooending cuts will be viciously opposed by the left politicians, not necessarily left voters.”

Are you kidding me? The population as a whole wants Defense spending cut and they don’t want SS cut. How many left politicians are talking about cutting defense and not SS? The population as a whole wants to increase taxes on the rich. How many left politicians want to do the same?

The population as a whole is vastly to the left compared to the politicians and the media.

@ PSGT – Agreed that people are willing to dig in to help the country if they see responsible action, but not if they don’t. I would like to see more focus on re-engineering. We’ve discussed the horrible spending v results in medical care. In education, the US is the third or fourth most expensive per-student (depending on your study) , not including the ~$100B in stimulus spending over the last two years, and yet we rank very low (about 15th to 37th) in key areas like literacy and mathematics . I am a strong supporter of education spending and believe that it should be treated on par with Defense, Social Security and Medicare/Medicaid. That said, in ALL of these four areas we are nowhere near getting the bang for our bucks (well, we get bangs for bucks in defense spending, but not enough bangs for too many bucks) and I don’t want to just throw more money at the problem hoping it will be fixed.

@ CS – I disagree that the population as a whole is vastly left compared to anything. I think the population as a whole leans left on social issues and right on fiscal issues, so there isn’t even really a center position. And I think some of the points you make are not as sound as you think they are.

Your argument about welfare programs benefiting the economy is a mixed bag. It is true that better medical care keeps people as active participants, and it is absolutely true that medical costs forcing people into bankruptcy hurt the economy. The theory that welfare and unemployment spending improve the economy, however, is a violation of the second law of thermodynamics 🙂 If I am a farmer, taking money from my pocket and giving it to someone else to use to spend to buy my food so I can pay taxes is a long term losing proposition because there are so many losses in the system. Many of those programs do provide a TEMPORARY stimulus because they prevent marginal companies from falling below critical mass and failing, but in a normal economic climate that’s not true.

Your statement that the US is nowhere near bankruptcy because interest rates are low is comparing apples and oranges. Bankruptcy means we can’t make enough to pay our debts, and if you’re borrowing money to pay your debts you’re headed for oblivion. Not to mention that the only reason our CURRENT debt is as manageable as it is is BECAUSE interest rates are low – if interest rates were not artificially being suppressed, we would go bankrupt even faster because the portion of our budget that goes to debt service would significantly increase.

As for your progressive income tax suggestion, I think you could do with a lot fewer brackets 🙂 Personal income taxes can – and should – be more progressive because people with a lot of money should pay more taxes than people with a little money (which isn’t true right now). You have to be careful, though, where you define “wealthy” because I qualify under the definition of family >= $250,000 per year but I certainly can’t afford a big tax increase (I can afford small ones). I have two small children and if you look at what it costs to get them educated on top of all the other expenses these days even $250,000 per year for a family is not that much, especially if you live somewhere with a high cost of living. Luckily I live in Oregon, but if I lived in San Francisco I would be fairly strapped.

Corporate taxes need to be higher as long as the corporations stay here to be taxed. In the world economy and with the Internet it’s just too easy to move offshore. I agree that corporate taxes should be higher, and I believe there is a lot we can do to make ourselves competitive with offshore options, but you do need to keep it in mind.

@CS Well, the population as a whole is vastly left of Rush and Glenn, so they are vastly left of something 🙂