From Michael Grunwald in Time Magazine. Finally someone called them out on this:

It’s really amazing to see political reporters dutifully passing along Republican complaints that President Obama’s opening offer in the fiscal cliff talks is just a recycled version of his old plan, when those same reporters spent the last year dutifully passing along Republican complaints that Obama had no plan. It’s even more amazing to see them pass along Republican outrage that Obama isn’t cutting Medicare enough, in the same matter-of-fact tone they used during the campaign to pass along Republican outrage that Obama was cutting Medicare.

This isn’t just cognitive dissonance. It’s irresponsible reporting. Mainstream media outlets don’t want to look partisan, so they ignore the BS hidden in plain sight, the hypocrisy and dishonesty that defines the modern Republican Party. I’m old enough to remember when Republicans insisted that anyone who said they wanted to cut Medicare was a demagogue, because I’m more than three weeks old.

The whole thing is only four paragraphs longer and worth every word. Go read it.

For details on the GOP counter-offer for averting the fiscal cliff, see this article. It cuts $600 billion from Medicare and other health care programs, $200 billion from Social Security, but keeps the Bush tax cuts for the wealthy. They also fail to specify which “loopholes” they would close to raise revenue.

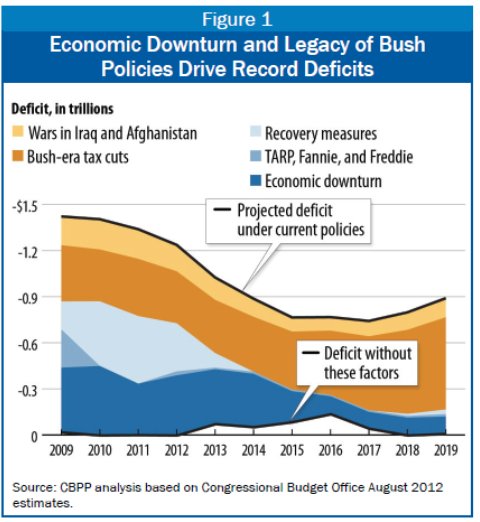

UPDATE: Short and (not so) sweet evaluation by Paul Krugman of the Republican “proposal”. Includes an interesting infographic:

By far the largest driver of the deficit (especially in the future) are the Bush tax cuts. And notice that the deficit started going down after Obama was elected. So tell me why do we need to cut Medicare and Social Security?

Krugman ends with a good snipe:

Oh, and for all the seniors or near-seniors who voted Republican because you thought they would protect Medicare from that bad guy Obama: you’ve been had.

Oh, and we haven’t heard from Ralph Nader for a while, but he has a very interesting way to significantly reduce the deficit — a small financial transaction tax on purchases and sales of stocks, options, and derivatives. Almost everyone in the US pays sales taxes every time they buy something (including their cars and homes), but a trader on Wall Street can buy and sell stocks worth millions of dollars without paying a penny. Nader is proposing a half-percent tax. Such a tax would actually help calm our stock markets, since it would reduce rampant speculation, slow down computer-controlled high-frequency trading, and lessen the “froth” caused by the current short-term trading mentality.

This is not just some crazy idea — the US imposed a 2% tax on the sale of stock in 1914 (it was eliminated in 1966). Last summer, fifty financial leaders (including past and present executives from Goldman Sachs, JPMorgan Chase and Morgan Stanley) signed a letter supporting a speculation tax. And a number of countries with strong and growing economies already have a sales tax on financial transactions (including UK, South Africa, Hong Kong, Singapore, Switzerland, and India).

Why is neither US political party willing to even consider this?

3 Comments

I think one’s got to be careful about the way even a 0.5% tax on stock (and presumably bond) transactions would significantly change the way financial markets work, and not necessarily for the better.

Perhaps a 0.05% tax would slow the high speed trading, and that would be a good thing.

But a 0.5% tax in the bond markets would obscure the outrageous 1% profits that bond dealers make, and drive back efforts to make credit markets more liquid and more transparent.

Let’s not forget that the value of stock and bond trading is not only in the movement of capital per se, but in the (limited) price discovery it affords.

Dan, sure, start it out at 0.05% or whatever.

But I think if it caused the problems you are worried about, we would have noticed that when we had such a tax (for 50 years), and places like the UK, Switzerland, Singapore, and Hong Kong would have noticed any problems. And you wouldn’t have execs from financial institutions supporting it.

Financial markets have changed substantially even in the last twenty years, and not all for the worst. The bond is well behind, which means there’s a lot of scope for improvement.

Could you point me to where either the UK, Switzerland, Singapore or Hong Kong levy a 0.5% tax on all stock sales?